Discover your true net income with our independent tax calculator-- see precisely what you'll maintain after tax, National Insurance, and costs. After partnering with Webgility, the firm incorporated all its ecommerce platforms with copyright, getting rid of human mistakes like dual and three-way bookings. A lower CPA suggests that ecommerce is getting consumers more cost-effectively.

When accountancy, a degree of settlement constantly needs to take place. This is the act of ensuring that bank statements and journals match. If financial institution declarations and journals do not match, there might be a mistake that requires to be cared for. Integrating your journal with your bank accounts prevents overspending from taking place. This bookkeeping technique is all about tape-recording deals as they happen. For example, when you purchase supplies, you can only record the transaction after cash has actually left your organization.

.jpeg)

However as the sales start rolling in, the not-so-fun stuff like tax obligation commitments, attaining ideal product pricing, and ensuring secure capital can make or damage a service. Xero supplies cloud-based bookkeeping software for small and medium-sized organizations. It supplies a host of finance features including endless individuals, double-entry bookkeeping, and budgeting support. You can additionally personalize your dashboard to review all your ecommerce metrics simultaneously.

Ecommerce accountancy should pay particular focus to the expense of goods marketed. This refers to all the costs called for to offer a product, not counting points like payroll or marketing. You'll intend to discover a freelance accountant that has experience working with ecommerce organizations like your own.

.png)

All your bookkeeping is based upon service records like financial institution statements, bank card statements, and invoices. Depending upon your state and your company's profits, you may require to file sales tax obligation on a monthly, quarterly, or yearly basis. If you file when a month-- or even when every 3 months-- you must place it near the top of your routine audit to-do list. By following this operations and leveraging bookkeeping software program, you can improve your economic management and gain useful insights to drive your eCommerce business ahead.

ecommerce accounting Mara Wilson Then & Now!

Mara Wilson Then & Now! Mason Gamble Then & Now!

Mason Gamble Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Barbara Eden Then & Now!

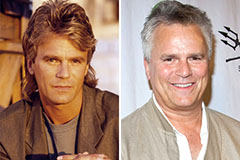

Barbara Eden Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!